💡 Quick Answer: Garmin watches are HSA/FSA eligible because they help prevent, manage, and reverse a variety of health conditions including cardiovascular disease, diabetes, sleep disorders, obesity, and chronic stress, and many others. According to IRS Publication 502, all you need is a Letter of Medical Necessity.

Luckily, we make it ridiculously simple. Crates Health is the fastest way to get your personalized and compliant letter for Garmin watches and thousands of other wellness products, plus we handle your reimbursements directly through our platform with just one click.

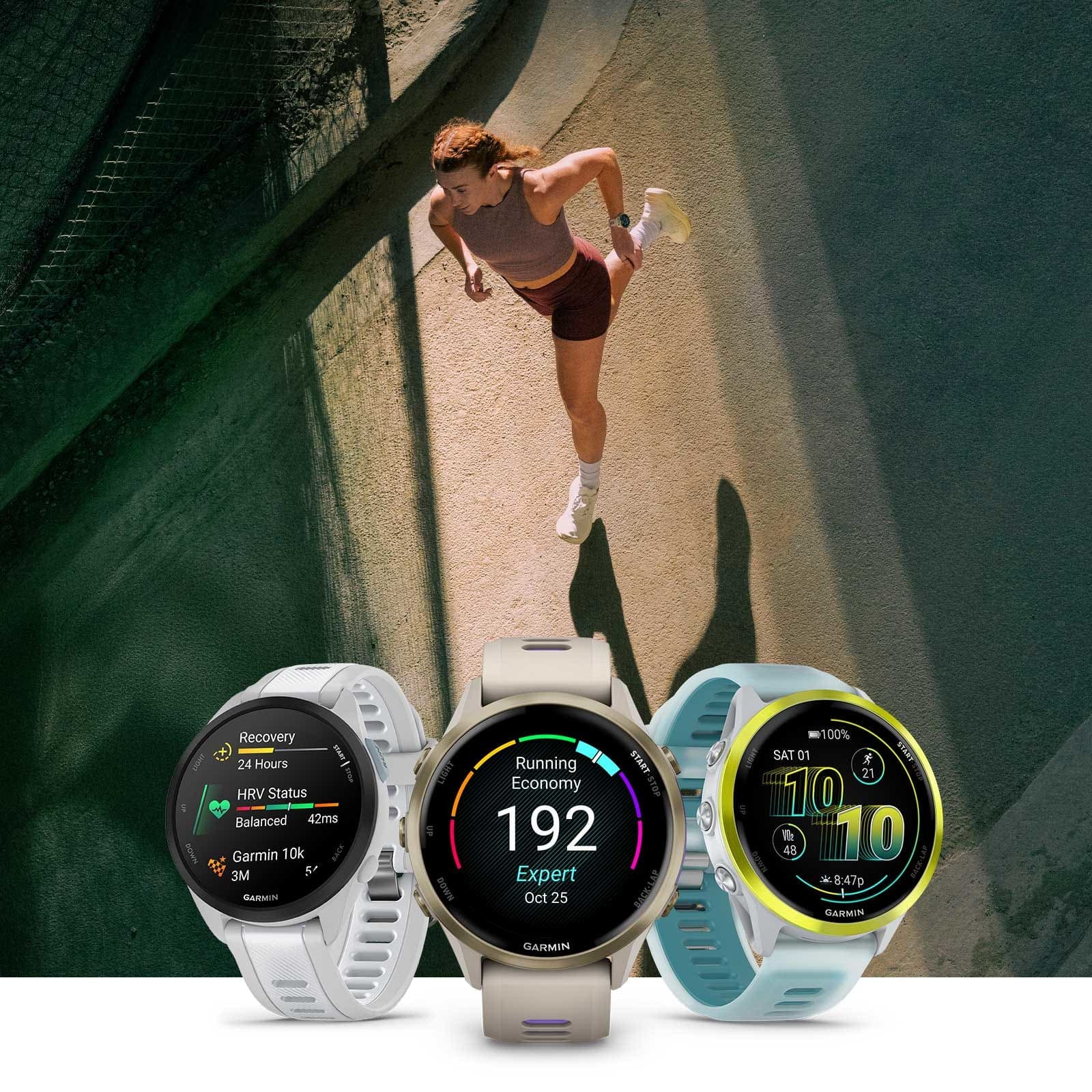

What is Garmin

Garmin is the gold standard for serious health and fitness tracking. While Apple Watch dominates the smartwatch market and Fitbit serves casual users, Garmin occupies a unique space: they build devices for people who actually want to understand and improve their health metrics. With battery life measured in days (not hours), GPS accuracy that rivals military-grade systems, and health tracking so detailed it borders on clinical, Garmin watches have become essential tools for everyone from weekend warriors to professional athletes.

The company’s 2025 lineup spans from the $249 Forerunner 165 for beginner runners to the $1,200+ Fenix for outdoor adventurers. But here’s what most people miss: these aren’t just fitness gadgets. They’re legitimate health monitoring devices that track heart rate 24/7, measure heart rate variability during sleep, monitor blood oxygen levels, detect irregular heart rhythms, analyze sleep stages, and provide stress management insights. In fact, Garmin partners with health research institutions like UCSF Cardiology to validate their sensors’ ability to detect conditions like sleep apnea, hypertension, atrial fibrillation, and diabetes.

Why Garmin Qualifies for HSA/FSA Eligibility

According to IRS regulations, fitness trackers and health monitoring devices can qualify as eligible medical expenses with a Letter of Medical Necessity. IRS Publication 502 states that medical expenses are “the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body,” but “must be primarily to alleviate or prevent a physical or mental condition or illness.”

This means Garmin devices can qualify for HSA/FSA reimbursement for prevention or treatment of:

- Cardiovascular conditions – continuous heart rate monitoring, irregular heartbeat detection, and cardiovascular fitness tracking (VO2 max)

- Diabetes and pre-diabetes – activity tracking for blood sugar management, stress monitoring, and metabolic health insights

- Sleep disorders – advanced sleep stage tracking, sleep score analysis, and breathing pattern monitoring

- Obesity and weight management – calorie tracking, activity goals, Body Battery energy management, and training load optimization

- Hypertension – stress tracking, breathing exercises, and heart rate monitoring for blood pressure management

- Mental health conditions – stress tracking, HRV status for nervous system health, and guided breathing exercises

- Chronic fatigue and recovery issues – Body Battery feature, training readiness scores, and recovery time recommendations

The key requirement is that a healthcare provider must note the health monitoring device as medically necessary for managing your specific health condition. This documentation comes in the form of a Letter of Medical Necessity (LMN).

Which Garmin Models Are HSA/FSA Eligible

The good news: virtually all Garmin health and fitness trackers with heart rate monitoring qualify for HSA/FSA with proper documentation. Here are the most popular eligible models:

Entry-Level Health Trackers ($249-$299)

- Garmin Forerunner 165 ($249) – Perfect for runners starting their health journey, with AMOLED display, training metrics, and sleep tracking

- Garmin Vivoactive 6 ($299) – All-around health smartwatch with animated workouts, Body Battery, and comprehensive wellness tracking

- Garmin Lily 2 Active ($249) – Compact fashion-forward tracker with full health monitoring in a smaller case

Mid-Range Performance Trackers ($400-$550)

- Garmin Forerunner 265 (~$450) – Bright AMOLED running watch with advanced training analysis, HRV status, and recovery guidance

- Garmin Venu 3 ($549) – Lifestyle smartwatch with speaker/mic, wheelchair mode, and comprehensive health features

- Garmin Forerunner 570 ($549) – Latest mid-tier running watch with enhanced training features and health monitoring

Premium Health & Performance Devices ($600-$1,200+)

- Garmin Forerunner 965 (~$599-$699) – Premium running watch with offline mapping and complete health suite

- Garmin Venu X1 ($800) – Sleek titanium design with advanced health metrics in an ultra-thin package

- Garmin Fenix 8 ($1,000-$1,200+) – Adventure flagship with expedition-level durability, multi-band GPS, and clinical-grade health sensors

All of these models include the core health tracking features that qualify them for HSA/FSA: 24/7 heart rate monitoring, HRV status tracking, advanced sleep analysis, stress tracking, Body Battery energy management, and blood oxygen monitoring (on most models).

How to Assess Your Eligibility

Traditional Route: Schedule an appointment with your primary care physician, discuss your health conditions and monitoring needs, and request a Letter of Medical Necessity if continuous health tracking is recommended as part of your treatment plan. This typically requires an office visit, potential wait times, and can cost $50-100+ depending on your insurance.

Faster, Smarter Route: Use Crates Health to get your Letter of Medical Necessity online in just a few minutes. Our platform connects you with licensed healthcare providers who can evaluate your conditions remotely and issue the appropriate documentation if you qualify. No office visits, no waiting weeks for appointments, and no surprise medical bills.

Frequently Asked Questions

Are other fitness trackers HSA/FSA eligible?

Yes. With proper medical documentation, you can use HSA/FSA funds for Samsung Galaxy Watch, Fitbit, Whoop, Oura Ring, Ultrahuman Ring and other health-tracking wearables when they’re recommended for treating specific medical conditions.

How does the reimbursement process work?

You’ll purchase with your personal card, save your receipt, then submit the receipt and LMN for reimbursement through your HSA/FSA administrator. With Crates Health, we simplify this process: upload your receipt and get one-click reimbursements directly through our platform.

What is a Letter of Medical Necessity?

A Letter of Medical Necessity (LMN) is a document from a licensed healthcare provider that explains why a Garmin watch is medically necessary for treating a diagnosed condition. It’s the official documentation proving your smartwatch isn’t just for general fitness. Each LMN typically remains valid for 12 months.

Will my HSA/FSA claim get denied?

With Crates, it rarely happens. That said, every HSA/FSA administrator is different, and some may initially deny claims due to receipt format, LMN documentation, or unclear medical necessity. Crates Health supports you through any denials and make sure you get reimbursed.

Can I use my HSA/FSA for Garmin bands and accessories?

Generally, no. HSA/FSA funds cover the device itself when it’s medically necessary, but accessories like bands, charging cables, and cases typically don’t qualify unless they’re essential to the medical function. However, many other wellness products qualify such as saunas & cold plunges, supplements, gyms & fitness, health tech, mental health, and sleep tech.

Does this work for older Garmin models like the Fenix 7 or Forerunner 255?

Absolutely. Previous-generation Garmin watches with continuous heart rate monitoring and health tracking features qualify for HSA/FSA reimbursement with proper documentation. The IRS cares about the health monitoring capability, not whether you bought the latest model.

Is the Garmin Fenix series HSA eligible?

Yes. The entire Garmin Fenix line (Fenix 7, Fenix 8, Fenix E) qualifies for HSA/FSA with a Letter of Medical Necessity. These premium adventure watches include the same clinical-grade health sensors found in Garmin’s dedicated fitness trackers.

Can I use my FSA for a Garmin watch?

Yes. Garmin watches are both HSA and FSA eligible with proper medical documentation. Keep in mind that FSA funds typically expire at year-end, so if you’re planning a purchase, consider the timing to maximize your benefits.